Why Does A Pe Deal Team Or Portfolio Company Executive Buy Consulting Services?

Would you like to work with private equity and venture upper-case letter funds?

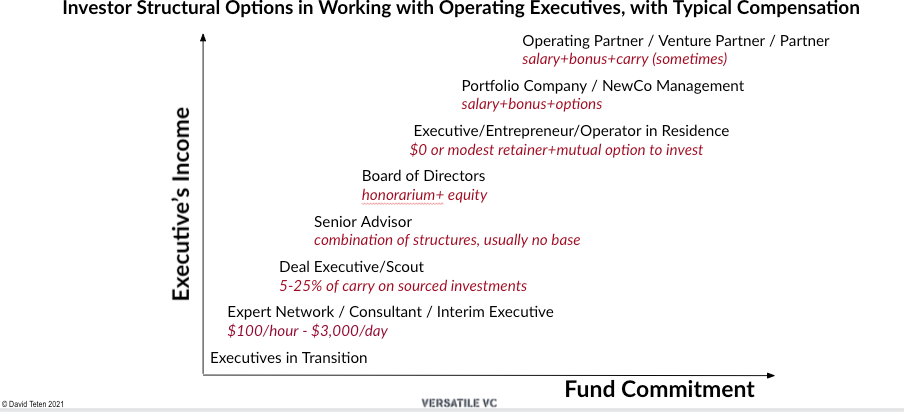

There are relatively few jobs directly within individual equity and venture uppercase funds, and those jobs are highly competitive. (See How to negotiate a partner role at a VC or private equity firm .) However, there are many other ways you lot tin work with and earn money from the manufacture. You tin can work equally a consultant, an acting executive, a board member, a deal executive partnering to purchase a company, an executive in residence, or as an entrepreneur in residence. Non surprisingly, the tighter your human relationship with the firm, typically the more coin you will earn:

Here'due south a video of a presentation and give-and-take on this topic which I led for GoingVC; the total deck is embedded at the bottom of this folio.

At Versatile VC , we've used all these models to work with talented business and technical leaders. We likewise manage Founders' Adjacent Move , a selective, free community for tech founders researching their side by side move.

This is office of a series on edifice your career in venture uppercase:

- Reading list for working in individual disinterestedness/venture capital , including all of the major online communities, programs, and educational options for people studying VC

- How to win consulting, board, operating, and investment roles with individual disinterestedness and venture capital funds (video)

- How to detect a job every bit a VC scout

- How to get a job in venture capital

- VC recruiters list and compensation data

- How to negotiate a partner role at a VC or individual disinterestedness house

- For emerging VC and private equity investors: accelerators, platforms, communities, and incubators

- Syllabus for how to launch, manage, and invest a VC fund

Venture capitalists often come from an operating background. However, historically about private equity professionals were sometime investment bankers and other finance professionals. And so private equity players gradually realized that value cannot be created through financial technology alone. A BCG study of 121 investments establish that operational improvement drives 48% of value creation in PE-backed companies . PE funds now almost always crave an upgrade in management and change management teams if necessary.

The simplest path frontward is to identify funds in your manufacture of expertise, and reach out. You can explore all of the models beneath with them. First, commencement by identifying the firms which are investors in companies with which you have work history. Second, more broadly, expect for investors in the industries in which you accept expertise. You tin identify institutional investors through one of multiple online databases:

Thank you to my co-author for this essay below, Paulina Symala, a Consultant at Oliver Wyman and a past intern of Versatile VC .

Expert Networks

Adept Network firms source subject matter experts from various domains and pair them with clients seeking topical or manufacture insights. They typically charge clients up to $1,200 per hour , and pay the proficient $100 to $500 an hour. (I founded Circle of Experts, an expert network which I sold to Evalueserve.)

The skillful network industry has grown an average four.5% annually between 2015 and 2020, its market place size topping $ane.3B in 2020. While the major clients were initially hedge funds and private disinterestedness firms, consulting firms now comprise 32% of total demand for expert network services.

Inex One, an Expert Network marketplace, has compiled a list of lxxx Practiced Networks , summarized in the graphic beneath :

The largest expert networks are:

- GLG , bookkeeping for approximately 50% of the industry'southward acquirement.

- AlphaSights , the 2d biggest generalist Adept Network later on GLG.

- Guidepoint services 6 major categories of clients globally, beyond several industries.

- Third Bridge hires and retains talent to "democratise the world's human insights and upend the traditional enquiry model."

Other notable proficient networks include Atheneum Partners , Coleman Research Grouping , Dialectica , ENG , Lynk Global , Mosaic , PreScouter , ProSapient , and Tegus . There are likewise proficient networks with sector or geography specialization. For example:

- SERMO is a social media network for physicians globally to exchange cognition and share challenging patient cases.

- Clarity.fm connects startups to experts in building new businesses.

- The Skilful Institute helps law firms and lawyers discover skillful witnesses for legal cases.

- Kingfish Group specializes in servicing the private equity industry.

- CAPVision is a primary research firm with a stiff focus on Asia.

Equally an independent consultant, working with expert networks allows you to interact and larn from professional investors, industry consultants, and corporations; earn competitive compensation; and receive referral fees for introducing colleagues. Typically y'all'll share your expertise in 5 primary ways: telephone calls, presentations/in-person meetings, surveys, white papers, and in-depth consulting projects.

Joining an expert network also saves you lot both time and fiscal resources. There is no membership fee to obtain access to potential projects with the expert network's clients. There are as well minimal marketing costs. While you should exist proactive well-nigh beingness top-of-heed for the kind of projects you'd like to piece of work on, the expert network will pair you with a customer, if there'south a lucifer. You lot too don't accept to spend fourth dimension on negotiating or chasing payment, equally the customer pays upfront and the house takes care of this for yous.

These kinds of engagements also offer plenty of flexibility. The networks' expectations towards you are minimal: once the expert network finds a fit between your expertise and a client's noesis requirements, they will send a request which you lot can take or turn down within 48 hours (usually). For confidentiality reasons, the consultation is held strictly between the client and the subject matter experts. Given that y'all are hired on a per-hr or per-project ground, there is no fixed obligation of time.

The criteria for offering your consulting services through an expert network are adequately specific, and summarized below:

| Attributes the Network Seeks | How the Network Assesses You |

| Relevant experience |

|

| Access to unique knowledge |

|

| Communication skills |

|

The expert networks unremarkably don't value social and direction skills, equally experts are mainly hired for the knowledge they possess, not for political or sales skills. This is good news for some people.

The key to success when working with expert and consultant networks? For starters, a detailed, upwards-to-appointment contour. Ensure that you're putting your best, digital foot forward on Linkedin and your personal website by:

- Currency . Go along your availability and biography up-to-date.

- Quantify your achievements. When writing your bio, the standard format is: "Achieved Ten by doing Y, which resulted in Z (a number, $, etc.)." For more, see how to write a biography that sells .

- Explain how you lot acquired your expertise , which helps in increasing people'due south perception of your legitimacy.

- Keywords. Brand certain to mention firms y'all take touched in the past – past employers, clients, or service providers. Also it'southward a skillful idea to utilize the terms that are specific to your manufacture, for example, industry jargon or technical terms .

There are a few additional steps you can take to win more consultations:

- Utilise for open up projects , which are listed on the system and likewise typically pushed to you lot via email.

- Mail your liaison when you take insight into a hot topic – for example, breaking news or a conference yous simply attended.

- Become on-call , i.e., point you're available on short detect for any immediate needs clients take.

To set your charge per unit, the Networks will typically suggest a modest figure, e.g., $200/hour. You're non beholden to this. If yous take unique expertise, the Network REALLY needs you and is not very toll sensitive. If hundreds of people have your expertise, then your rate needs to drop to something in the range of their suggested figure. My record: I once paid someone £5,000 an hour. The client wanted his expertise; he was one of the top 5 people in the globe in his domain (pharmaceutical Thousand&A); so I had to pay information technology. Some other example: a lobbyist for U.S. multinational companies in China writes well-nigh how his knowledge of U.S.-China relations and Chinese commercial policy experience allows him to charge between $400 and $1000 hourly for a call.

When you're in a consultation, we recommend follow these guidelines:

- Ask questions to understand the customer's hot buttons & make sure to answer them.

- Observe compliance restrictions tightly.

- Review current news. Equally a discipline thing expert, you're expected to stay on top of contempo developments in your field of knowledge.

- Acknowledge your limits. It is better to be upfront about what you don't know or can't do, than to improvise and risk disappointing the client.

- Offer referrals (via the proficient network). The customer is then able to obtain specifically what they need, and typically you'll earn a referral fee.

As a side by side step, we recommend that you register at the major expert network websites, as well every bit LinkedIn and job boards, if you lot haven't already. Make sure to include your biography and resume. You could as well consider condign a public adept: Profnet and HelpAReporter connect subject matter experts to journalists needing an expert opinion for an article or news piece.

To learn more virtually this space, see Borough'south report on The Rising of the Good Economy .

Acting Executives and Consultant Networks

Acting executives typically engage in projects of two-6 months duration, as opposed to engaging in curt telephone calls like experts from expert networks. A few, well-known networks include Business organisation Talent Group , Catalant , Eden McCallum (focus on UK and the netherlands), EIM , Xi Canterbury , Expert360 (Australia), ForteOne , HighPoint Associates , Bear on Executives (UK), SMA , Talmix (UK), Umbrex , and 10EQS . For additional, Europe-based Acting Service Providers, see the Constitute of Interim Management Interim Management survey .

Peculiarly relevant is Startups.com , which aid tech startups place consultants with relevant domain expertise. Eternalize is an "on-demand executive talent marketplace" focused on "startups and scaleups", that connects "high-growth companies with trusted and flexible executive talent". We also suggest cheque out Braintrust (portfolio visitor), the commencement user-controlled talent network that connects organizations with highly skilled tech talent, who keep 100% of their market charge per unit.

Some networks are more specialized. For example, in that location are several networks of financial professionals:

- Squeeze box Partners consultants " work alongside sponsor management teams – focusing exclusively within the Part of the CFO, (…) empowering the unabridged finance role – including FP&A, operational and technical accounting, 1000&A, and performance improvement".

- Tatum Executive Services provides "CFOs, CIOs and senior finance professionals [to help] lead [companies] through any challenge".

Other specialize in sure target markets. For example, BlueWave connects private disinterestedness clients with "3rd-party resources to meet [their] specific needs in due diligence and value creation".

For greater insight into the average interim executive profile, consult InterimExecs' survey .

Straight Consulting

There also exist several other means to country consulting gigs, aside from joining the networks mentioned above. You can become an advisor to one of the major consultancies. Some maintain a database of outside consultants (due east.g., PwC'due south Talent Exchange ). Adham Abdelfattah , an counselor to the Senior Partners at McKinsey and Venture Partner with Versatile VC, said, "Familiarity with technology topics is extremely valuable to become an counselor for the pinnacle firms. Tech is their Achilles heel, and they're always looking for seasoned talent that understands both engineering and direction to human action as advisors. Bones networking (and even cold emails) with these firms can suffice if the person has relevant expertise. All information technology takes is 1-two partners to desire to onboard a person every bit an advisor once".

You tin can likewise chapter with a specialty consultancy in your niche. In that location's a huge world of smaller consultancies which work with outside, part-fourth dimension consultants on an as-needed basis. It's much easier to become on their "call list" than to get a full-time chore. TheConsultingBench offers a database of over 600 consulting firms.

Board of Directors

When hiring their directors, boards tend to look for:

- Proven leadership feel;

- Specific skills or feel – for example, a fiscal background, international experience, position equally active or retired CEO, experience in dealing with challenges faced past a company or CEO; and

- Network – for example, connection to potential clients.

To become a board fellow member, y'all must take a history of leadership and / or management experience at the C-level. To join a board, at a minimum we recommend transport your resume to all the major recruiting firms, as most acme recruiting firms offer a lath placement service. Building relationships with major investors in your sector will likewise increase your odds of getting invited to board roles.

We advise look at these resources:

- DirectorsandBoards "provides public and private company directors, leaders and owners of multigenerational family unit businesses and C-suite executives with the knowledge and skills to be successful in their roles".

- NACD (National Association of Corporate Directors)'s Accelerate program provides participants with " the tools, resources, and exposure that are essential to launching a successful career every bit a manager".

- FasterLandings offers a " Landing Lath Seats " plan to assistance candidates get on Boards.

- The Private Directors Association frequently hosts webinars on board-related topics (for instance, "Board Responsibilities During a Pandemic" or "How to Market Yourself for a Board Seat.")

- The Institute for Corporate Directors in Canada helps its members " perform their director role effectively and make an appropriate contribution in the boardroom (…) [by offer] professional development programs that provide value-added managing director pedagogy and learning opportunities."

Currently, many boards are also aggressively seeking to go more various, as 61.4% of all board positions are nevertheless held past white men. The 2020 Spencer Stuart Board Index finds that currently, in S&P 500 boards, women account for 28% of directors while minorities account for 20% .

In terms of background and office, 17% of new Directors are Active (not retired) CEOs or presidents, as opposed to 26% in 2010. New Directors come increasingly more from financial backgrounds (27% in 2020 vs 21% in 2010) and functional roles (22% in 2020 vs 18% in 2010).

Useful resources for women and minorities seeking board seats include:

- Boardroom Jump prepares "talent in the diversity aggregate to appoint in governance leadership preparation for the indicate in time when increasing numbers of companies make diversity and inclusionary practices a main focus".

- Catalyst has compiled a listing of "organizations and institutions that offer programs for networking, education, leadership and community" which help executive women interested in lath service.

- WCD (Women Corporate DIrectors) is "the world'southward largest membership system and community of women corporate board directors", supporting its members in "connecting with peers and advancing visionary corporate governance".

- DirectWomen seeks to " increase the representation of women lawyers on corporate boards" by "[ developing] and [positioning] women attorney leaders for lath service. It also serves as a resources for companies seeking qualified women board candidates."

- Executive Leadership Council is an organization comprising electric current and former Black CEOs and senior executives at Fortune 1000 and Global 500 companies. Its " Corporate Board Initiative " "builds awareness, improves readiness, and enhances the visibility of ELC members who are interested in and actively pursue corporate board service".

Further reading

- 7 Ways to Position Yourself to Become on a Board

- Want to Join a Corporate Board? Here's How

- Startup lath meetings template presentation

- Looking for a Board Seat? Networks Are the Way to Find—and Be Institute

- Ten Networking Strategies to a Seat on the Lath

- Spencer Stuart's board index (bounty data)

Senior Advisor Networks

Senior Advisors are an investor-sponsored group of senior executives who work closely with funds to source deals and / or portfolio companies to provide board service and mentor. For case, I helped build Chambers Street Executive Network, a proprietary counselor network for Goldman Sachs Special Situations Group.

This position typically requires a monthly time delivery of ii to x hours. Pay volition vary based on service given, and may come in as a retainer or service fee (payable directly past the visitor in many cases, not the fund).

Senior Counselor networks offer a depression-fixed-toll, loftier-render talent puddle option. They differ from the traditional talent sources we list in a higher place in four master ways:

- Duration: Typical relationship is 6 months to many years, versus ane-2 hours to three months for experts or permanent for recruited executives.

- Illustrative cost: Senior advisors are paid typically on a servant, equally opposed to a $1,000/hr rate for expert networks, $300-$700/hr rate for consultants, or ⅓ of compensation for hired executives.

- Commuter of executive bounty: Because of the long term human relationship, you tin pay the senior counselor based on value created and continued involvement with client companies, instead of length of consultation (experts and consultants).

- Confidentiality: You can ask exterior consultants to sign NDAs, but practically speaking they are a greater risk of information leakage than a long-term senior advisor.

Certain VC funds offer "Fellowships" for industry executives. For case, Shift's Defense Ventures Program offers "8 cohorts of up to 25 Fellows from across the U.s. Armed Services, (…) immersion programs focused on venture capital, the engineering science startup ecosystem, cybersecurity, and artificial intelligence. Next year will also run into the introduction of an executive seminar, a high-impact week-long version of the Fellowship, for senior leaders of the Department of Defence and U.S. Military machine."

Private Equity Deal Executives

Another choice is to await for a company to buy, and partner with an investor to finance that. A Bargain Executive (sometimes called an Executive in Residence or Acquisition Entrepreneur) looks for a company to invest in or build, and typically serve in as CEO. The office usually pays a modest retainer with the incentive of a finder's fee and/or CEO role in the new company. To become a Deal Executive, you typically have a history of successfully leading a company at the C-level, or every bit a direct report to C-level. You must also offering a deal thesis or letter of intent to a private equity/VC firm.

Individual equity funds are primarily looking for deals, not executives. In order of desirability:

As a Deal Executive, you should arroyo PE funds with a well articulated deal thesis and position yourself as the "gateway" to this bargain. Information technology besides has to be correctly scoped for it to be apparent that you'll be able to find the right deal. A skillful investment thesis includes a few central elements:

- Articulate definition of industry, in terms of niche, size, geography, etc.;

- Transaction rationale consistent with the visitor'south growth prospects;

- Basic financial markets assay – trading range, feasibility, etc.;

- Outline of value-cosmos opportunities and plan for pursuing them;

- Explanation every bit to why yous and your team are ideally suited to lead the effort;

- Roster of 5-20 target companies;

- Status of discussions with targets (if any); and

- Thoughts on likely leave (IPO, strategic buyer).

Similarly, you should also present a Bargain Memo , which should include:

- One-folio teaser (the cover e-mail);

- Business organisation program;

- Executive profile;

- Forecasts – strategic, operational and fiscal ones.

Individual equity investors are seeking the "3 Cs" in Deal Executives: Credibility, Compatibility, and Bargain-Catching:

- Credibility . To announced credible, and able to practice the chore, you should have previously held CEO-level positions, or accept straight reported to C-level executives. Ideally, you lot accept 10+ years in your target manufacture or related marketplace and x+ years leading P&Fifty, preferably also residue sheet feel. For additional credibility, it'due south best that you accept personal capital to invest to testify that yous take peel in the game. The specific corporeality of which should be proportional to your historic period: a 35 yr erstwhile is not expected to have is not expected to have the same amount of savings every bit a l-year-erstwhile. Ideally, you would have a management team set, corporate governance skills (board feel), besides every bit investor relations experience.

- Compatibility . To ensure common compatibility, your goals and incentives should be aligned with that of the private equity or VC fund, too as the timeline for realizing them and leave strategy. Naturally, having some personal chemistry makes not but for a more pleasant working environment, but allows for greater synergies to be realized when working together.

- Deal-Catcher . Deal-catchers are usually entrepreneurial and sales-oriented, with a willingness to relocate, if needed. As a deal-catcher, yous're expected to proactively seek to identify deals . You should also be financially stable, and ideally have a supportive spouse , in order to exist able to become without bacon during the search for deals. Ideally, you would also take acquisition experience, to facilitate the procedure.

Partnering with operating executives is a successful strategy which is a focus for only a small number of firms, many of whom market place themselves as search fund sponsors. U.S. funds whose cadre strategy is to partner with executives to execute a transaction and bring in new direction upon investing include, for case, Broadtree Partners , Purchase+Build Fund , Endurance Search Partners , Frontenac , GTCR , Housatonic Partners , NextGen Growth Partners , Pacific Lake Partners , Post Capital letter Partners , Search Fund Accelerator , and TDV .

Private equity/executive intermediaries are hybrids of an investment depository financial institution and recruiter, which work with executives throughout the process to assistance execute a transaction. Examples include:

- Blackmore Partners helps funds detect executives with " Full P&Fifty Responsibility of $100 meg or more in work history. Currently employed in senior leadership positions. 10+ years of industry experience".

- Harvey & Company is a buy side acquisition advisory and principal investment firm, that employs an " executive-first model, partnering with proven operators that bring exceptional industry experience and connections that tin be leveraged to build businesses".

- Orbit Partners "helps the best investors partner with the best advisors to successfully arts and crafts deals."

Private disinterestedness fund / executive intermediaries have a standard process for executing transactions:

- Review the industry for feasibility past looking at market trends to identify whatever opportunities, conducting valuation analysis, reviewing capital letter-intensity requirements, conducting fragmentation assay for opportunities to acquire smaller players in a given sector.

- Contour executives to assess candidacies, based on the 3 desired characteristics mentioned to a higher place.

- Source companies for the transaction.

- Source sponsors for the transaction.

The society of points 3 and 4 in a higher place is interchangeable, as an executive has ii main paths to cull from in pursuing a transaction:

- Finding the company and getting close to signing a Alphabetic character of Intent, then pursuing a sponsor; or

- Finding a sponsor and then searching for a company, where the executive screens for funds with a track record of pursuing executive-led transactions and interest in manufacture. This strategy is even more prevalent in larger deals.

Many companies adopt to sell to management, fifty-fifty at risk of a lower price than they might get from an auction. Primary reasons as to why that'south the case include secrecy, continuity, speed, lower investment cyberbanking fees, and "dummy insurance" (not looking dumb for selling a company at likewise low a cost). The selling company may prefer to keep a pale in the spunoff company, which can exist easier when selling to a known party.

The process for completing a transaction has five main steps:

Stride 1: Launch Relationship (2 – 4 weeks duration)

Reach out to funds that are in your industry and value your expertise. Hold initial meetings to begin the relationship and appraise the investment thesis.

Stride two: Finalize partnership between executive and fund (1 – 4 weeks duration)

Refine the thesis with the other party and agree on compensation, economic science and exclusivity. Groundwork checks are conducted and a deal origination programme is formulated.

Pace 3: Identify & Contact Opportunities (one – 12 months duration)

At that place are two approaches to doing so. In the concept-driven approach , you'll search for industry inflection points which may indicate an investment opportunity. In the opportunistic approach (network), you will network through every possible channel to find an opportunity.

Footstep four: Evaluate Targets (upwards to 3 months duration)

The key questions to ask include:

- Can a deal be made?

- Tin can nosotros involvement investors?

- Tin can you "bulldoze" the bargain?

Step 5: Closing (up to 3 months elapsing)

The table below summarizes the typical economic science for mid-market private equity acquisition, for private equity group ("PEG"), deal finders, investment bankers, and other executives:

| Fee Type | Payer | Amount | Recipient of Payment |

| Transaction Fees | Capital Providers | 0.v% – 3.4% of deal size* | PEG pays finder's fee of 1-iii% of enterprise value plus sometimes carry, to deal finder + buy-side investment depository financial institution (if any). (Company (specifically selling shareholders) pay investment banker seller'southward fee.) |

| Monitoring Fees | Company | 0.2% – 4.four% EBITDA (median 1.2%)* ** | Visitor pays outside board members for ongoing services (~$5k+/meeting + equity incentives) |

| Expenses | Company | Mail-bargain expenses, not pre-deal | Company pays PEG for mail-deal expenses. Important for buy-side operating exec/investment banker to become PEG to commit to pay broken bargain costs. |

| Investment Rights | – | – | Commonly unlimited co-invest rights for executives involved, with no PEG management fee. Executives volition, however, pay pro rata monitoring/other fees. |

This does non reflect bounty for an executive'due south function as a company employee post-deal. Annotation that transaction fee and carry are inversely related.

* Robert Seber, Dechert LLP, "Transaction and Monitoring Fees: Does Anything Go?", 2003.

** The PEG's fund documents will by and large discuss whether a portion of that fee (oft half) is gear up off against management fees that the LP's would otherwise owe.

Other data based on Akoya Capital letter, Oberon Securities, and other interviewees.

VC Entrepreneurs in Residence

Certain VC funds proactively seek out qualified Entrepreneurs in Residence. Although the role is constantly evolving , VC EIRs are usually previously successful entrepreneurs who are building a startup leveraging the VC's support. In improver, they may accept responsibilities to back up existing portfolio companies and/or evaluate potential deals. Many EIRs are compensated with zilch income until they found a company, just there are some who are earning a retainer typically in the range of $ninety,000 to $150,000 .

Among the venture capital funds with formal EIR programs are:

- General Catalyst has an XIR (Executive-in-Residence) program, where they "collaborate with world-class executives to create a new business organization or place an existing growth-stage business concern to transform with them".

- Foundation Capital selects several candidates to develop businesses for emerging technologies. Ani Chaudhuri writes most his experience as an EIR working with Blockchain technology.

- VersatileVC offers an Entrepreneur in Residence program for founders seeking to launch a company that fits the house's investment criteria .

Further Reading

- Inovia Capital writes almost what they look for in an EIR .

- Jah Ying Chung, co-founder at The Good Growth Co., shares her feel as an entrepreneur-in-residence at Betatron , Hong Kong's only venture-backed accelerator.

- Several ex-EIRs share their experience on Quora .

Venture Partner/VC Scout programs

Some VCs have formal "Picket" programs to compensate people for sourcing investments. One of the best known is Sequoia 'due south decade-old Watch plan, which allocated $100k to each scout from its $180M scout fund .

Compensation for Scouts more often than not involves receiving a fixed fee and/or a percent of returns for deals that go through, just no guaranteed bounty. For example, Jason Calacanis shares in his book Angel the bounty structure for Sequoia's Sentry program: 45% of returns are given to the Lookout man, 50% to Sequoia, and the remaining 5% to a bonus puddle for other Scouts in the program. The awarding process for joining a Scout plan can exist very competitive, with some programs receiving thousands of applications per position.

Jai Malik, Venture Partner at Republic and ex-corporate Scout for Tata Communications, shares advice on becoming a Scout: " I think the near of import thing they saw was that I was open to learning whatever information technology took to get the job done. I think that'south pretty standard with other positions. How well yous tin show that you are committed to what you want to achieve." Among the other firms with scout programs: Accel, Ada Ventures, Atento Capital, Atomico, BackedVC, Bloom Venture Partners, Blossom, Chapter I, Contrary Upper-case letter, Gen Z Scouts, GGV Capital letter, Harlem Capital, Index, Indie VC, Kleiner, KPCB, Lightspeed, New Stack Ventures, Permanent Disinterestedness, Saison Capital, Sequoia, Academy Growth Fund, Upfront, and Hamlet Global.

Some VC funds offer fellowships for students to work for portfolio companies and attend events hosted by the VC, e.m.:

- Bessemer's Fellowship Programme places students with "some of the fastest-growing technology companies in the globe to learn invaluable work experience and access to mentors, industry professionals and the Bessemer Fellows customs";

- Fellows of the 8VC Fellowship " complete a software technology internship at an 8VC portfolio company while attention weekly Fellowship events to see and acquire from notable entrepreneurs, executives, and investors in our network from Silicon Valley and beyond";

- The Soma Capital Fellowship allows students to "[work] for a seed-phase Soma Capital portfolio visitor as a design, applied science, or business organization intern, then hone [their] idea with Soma'south aid in the incubation stage."

For a total list of fellowships, see the VC Fellowship database.

Further reading on scout programs:

- What is a venture partner and how do I become ane?

- How to rent a venture partner and how much to pay?

- Elad Gil, serial entrepreneur and ex-VP at Twitter, further shares communication on becoming a successful spotter .

- Ben Casnocha provides a useful FAQ on Scout programs

- Adam Gering, currently Manager of Research for a fintech company and previously Software Engineer at Microsoft, shares his thoughts on condign a Scout for VCs.

Other resource:

- Here is the slide deck from the video presentation at the beginning of this essay:

- How to negotiate a partner role at a VC or individual equity house

- Reading list for analysts and associates in private disinterestedness/venture capital

- Microcredentials for the Effective Venture Uppercase or Private Disinterestedness Investor

- Venture uppercase/private equity compensation data and recruiters list

- Express partner checklist for evaluating funds

- How to negotiate and evaluate your job offering

- How to write a resume that sells

* Disclosures: I'm an investor in Braintrust via HOF Capital letter , where I was formerly a Managing Partner.

I published this last calendar week in Techcrunch .

Why Does A Pe Deal Team Or Portfolio Company Executive Buy Consulting Services?,

Source: https://teten.com/how-to-win-consulting-board-and-deal-roles-with-private-equity-and-venture-capital-funds/

Posted by: graygoodir80.blogspot.com

0 Response to "Why Does A Pe Deal Team Or Portfolio Company Executive Buy Consulting Services?"

Post a Comment