Are Payments To Re-employment Service Fund Deductible On Business Return

Editor's note: On Tuesday, May quaternary the PPP ran out of general funds and the SBA stopped accepting new PPP loan applications. A reserve of funds is still available for community financial institutions that lend to businesses run by women, minorities, and underserved communities. Additionally, a reserve of funds remains for applications previously submitted but not yet reviewed by the SBA. If you have already submitted your loan application, all the same, this does non guarantee you funding.

On December 27, 2020 the U.S. federal regime signed a new beak into police. Included in this beak is a 2d stimulus package for businesses with a top up of the Paycheck Protection Programme (PPP).

Whether yous're applying for a outset draw PPP loan or a second draw PPP loan, here's everything yous need to know.

What is the Paycheck Protection Program?

The Paycheck Protection Program is a loan program that originated from the Coronavirus Aid, Relief, and Economical Security (CARES) Human activity. This was originally a $350-billion plan intended to provide American small businesses with viii weeks of cash-menstruum assistance through 100 percent federally guaranteed loans. The loans are backed past the Pocket-size Business Assistants (SBA). You tin can read the bill in its entirety here.

The program was then expanded past the Paycheck Protection Program and Health Care Enhancement Human activity in tardily April, adding an additional $310 billion in funding. The Paycheck Protection Programme Flexibility Deed made important changes to the program allowing for more time to spend the funds, and making information technology easier to get a loan fully forgiven.

And so on December 27, 2020 a second stimulus package was signed into law topping upward the plan with an additional $285 billion in funding and updating the eligible expenses. Information technology also opened up a second PPP loan for businesses that used up their first PPP loan and accept experienced a 25% or greater decrease in revenue.

PPP loan - highlights

The following is a high-level overview of the PPP loan program, which we'll cover in more detail in the residuum of this article.

-

All pocket-size businesses are eligible

-

The loan has a maturity rate of ii years and an interest rate of ane%.

-

Loans made afterward June 5, 2020 accept a length of v years.

-

The loan covers expenses for 24 weeks starting from the loan disbursement engagement

-

No need to make loan payments until either your forgiveness application is candy, or 10 months after your 24-week covered catamenia ends

-

No collateral or personal guarantees required

-

No fees

-

The loan can be forgiven and essentially turn into a not-taxable grant

At Bench, we're helping businesses navigate stimulus funding by connecting them to lenders and profitable with PPP forgiveness applications.

Am I Eligible for a PPP loan?

Paycheck Protection Program loans are farther reaching than SBA disaster loans. Small businesses, sole proprietorships, independent contractors, and self-employed individuals are all eligible.

-

Sole proprietorships will need to submit a Schedule C from their revenue enhancement render filed (or to exist filed) showing the cyberspace profit from the sole proprietorship.

-

Independent contractors volition need to submit Class 1099-MISC (now 1099-NEC in 2020) in addition to their Schedule C.

-

Cocky-employed individuals will need to submit payroll tax filings reported to the Internal Revenue Service.

For second draw PPP loans in 2021, a key qualification was introduced. Businesses looking to utilize for their 2d PPP loan will need to prove a 25% or greater reduction in revenue. This volition be shown by comparison revenue between any quarter in 2020 with the same quarter in 2019.

For example, say a concern recorded $20,000 of sales revenue in the second quarter (Q2) of 2019. They would exist eligible for PPP funding if they recorded $15,000 of sales revenue or less in Q2 2020.

Further reading: How to Calculate a 25% Reduction in Acquirement for PPP 2

What can a PPP loan exist used for?

At least 60 percent of the PPP loan must be used to fund payroll and employee benefits costs.

The remaining 40 percent can be spent on:

-

Mortgage interest payments

-

Rent and lease payments

-

Utilities

-

Operations expenditures such as software and bookkeeping needs (like Bench)

-

Property damage costs due to public disturbances not covered by insurance

-

Supplier costs such as cost of goods sold

-

Worker protection expenditures to exist COVID compliant

If you lot stick to these guidelines, you'll be able to have 100% of the loan forgiven (effectively turning information technology into a tax-gratis grant).

Alert: As part of your application, you'll be asked to certify that you volition spend the funds in the appropriate way. If you don't spend the funds in the right way, you could be charged with fraud.

What counts as "payroll costs"?

Payroll costs under the PPP plan include:

-

Salary, wages, commissions, tips, bonuses and hazard pay (capped at $100,000 on an annualized footing for each employee)

-

Employee benefits including costs for vacation, parental, family, medical, or sick leave allowance for separation or dismissal; payments required for the provisions of group wellness care benefits including insurance premiums; and payment of whatsoever retirement benefit

-

State and local taxes assessed on compensation

-

For a sole proprietor or contained contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized footing for each employee.

In other words, near payroll costs are covered. However, the following scenarios are not covered:

-

Payments made to independent contractors

-

S corps and C corps owners who aren't on payroll (shareholders distributions don't count as payroll nether this programme)

The $100,000 salary cap

As mentioned above, payroll expenses are capped for individuals earning over $100,000.

If you or whatever employees had an annual bacon over $100,000 in 2019 or 2020, you can merely claim $100,000 (and nothing above information technology). So if an employee makes $120,000, y'all would subtract $xx,000 from their salary for the purpose of the PPP. This would give you $8,333.33 as a monthly average payroll ($100,000 divided by 12).

If you are a sole proprietor or independent contractor without payroll and your net turn a profit was over $100,000 in 2019 or 2020, this volition too exist capped at $100,000. Y'all would divide this past 12 to go $8,333.33 as your monthly average payroll.

How much PPP funding can I receive?

The maximum amount you can receive from your SBA-approved lender is your monthly average payroll price in 2019, 2020, or the one year flow before the application. Multiply information technology past 2.5, up to a maximum of $two million.

For businesses in the food and accommodation industries, y'all are eligible for iii.5 times your boilerplate payroll costs, also with a maximum of $two million.

If you are a seasonal employer, the monthly average payroll cost will exist calculated differently. You can utilize any 12-calendar week menstruation between Feb 15, 2019 and February 15, 2020.

Here'due south a full rundown on how to calculate your PPP loan amount.

How do I utilise for a PPP loan?

The SBA itself doesn't lend y'all the coin, they just "back" the loan that the lender provides. You can bank check out the SBA'southward Lender Match tool to find an eligible SBA 7(a) lender.

As part of your application, you'll be asked to verify:

-

Electric current economical uncertainty makes the loan necessary to back up your ongoing operations.

-

The funds volition be used to retain workers and maintain payroll or to brand mortgage, lease, and utility payments.

-

Documentation that verifies the number of full-time equivalent employees on payroll and the dollar amounts of payroll costs, covered mortgage interest payments, covered rent payments, and covered utilities for the 24 weeks afterward getting this loan.

-

You admit that the lender will summate the eligible loan corporeality using the tax documents you submitted. You assert that the tax documents are identical to those y'all submitted to the IRS.

-

If you are applying for your 2nd draw PPP loan, you accept already used up the funds from your first draw PPP loan.

Financial documentation you'll demand

You'll need to provide payroll/bookkeeping records to testify your payroll expenses.

That could include:

-

Payroll processor records

-

Payroll revenue enhancement filings

-

Payroll tax forms from 2019 or 2020 (Forms 941, 940 and W-3)

-

Course 1099-MISC records

-

Schedule C for a sole proprietorship

If you have employees (and yous're paying yourself through payroll too), the easiest manner to get the financial data you'll demand is by downloading a payroll report through your payroll provider.

If yous're cocky-employed and don't yet have a completed Schedule C to submit, you will likely need to get retroactive bookkeeping to summate your cyberspace profit for your Schedule C. Apart from bookkeeping, it will be very difficult to accurately prove your internet profit, which is the number your PPP loan amount will swivel on. If you don't have a reliable bookkeeping solution in place, Demote can exercise your accounting for you. Learn more than almost our catch upwards bookkeeping services.

If you own more than one business

We are hearing reports that entrepreneurs who own more than one business are having difficulty getting relief funding when their businesses don't have cleanly separated finances. If y'all own more one business, information technology'southward important to go separate bookkeeping done for each business organisation. This will get doubly of import when information technology comes time to prove your expenses for loan forgiveness.

How to apply for PPP loan forgiveness

In the 24 weeks following your loan signing appointment, all expenses related to the following tin can be forgiven:

-

Payroll—salary, wage, holiday, parental, family unit, medical, or sick leave, health benefits, bonuses, hazard pay. Individual compensation is capped at $100,000 annualized.

-

Mortgage interest—as long as the mortgage was signed before February 15, 2020

-

Hire—as long as the charter agreement was in event before February 15, 2020

-

Utilities—as long every bit service began before February xv, 2020

-

Operations expenditures—any software, cloud computing, or other human resources and accounting needs (similar Demote).

-

Belongings harm costs—any costs from damages due to public disturbances occurring in 2020 and not covered by insurance.

-

Supplier costs—whatsoever buy order or gild of goods made prior to receiving a PPP loan essential to operations.

-

Worker protection expenditures—any personal protection equipment or property improvements to remain COVID compliant from March 1, 2020 onwards.

Yous'll demand to keep your records and have accurate bookkeeping to prove your expenses during the loan period. Y'all volition also need to accept spent 60% of the loan on payroll in order to qualify for forgiveness on the entire loan. Bench's bookkeeping services can help you stay on meridian of your expenses to ensure you're maximizing your forgiveness amount.

When your covered period is upwardly (or your PPP funds are spent), you will apply for forgiveness through your lender. Typically, this is being handled through online portals. Bank check your lender's website to run across if one is available.

In one case your lender has received your application, they must brand a decision within 60 days.

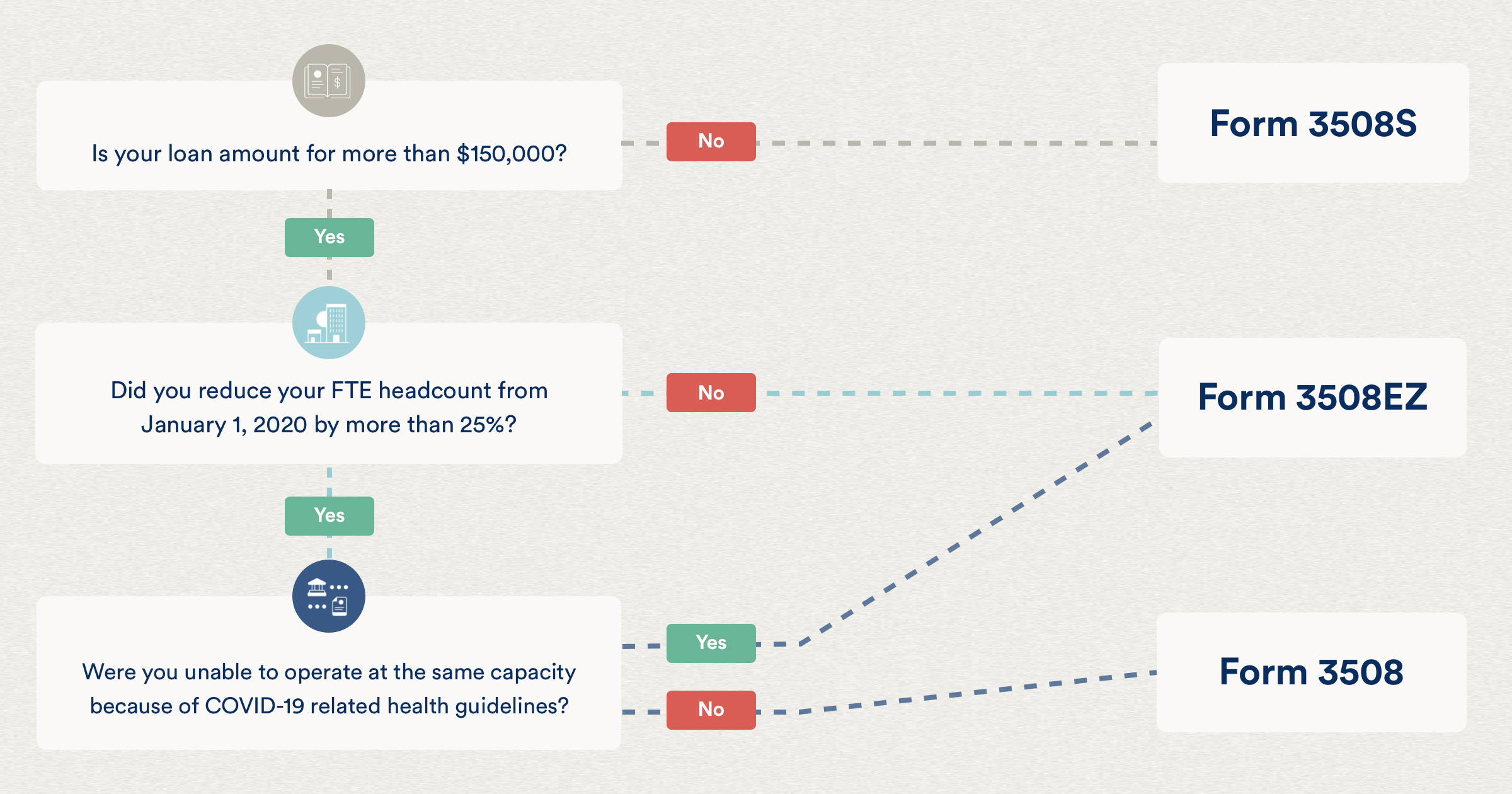

Use our guide beneath to figure out which PPP forgiveness application form you should use.

PPP forgiveness requirements

The purpose of the Paycheck Protection Programme is to, well, protect paychecks. Y'all must commit to maintaining an average monthly number of full-fourth dimension equivalent employees equal or in a higher place the average monthly number of full-time equivalent employees during the previous 1-year period. And y'all must spend 60% of the loan funds on payroll.

The corporeality that can be forgiven will exist reduced…

-

In proportion to whatsoever reduction in the number of employees retained.

-

If whatsoever wages were reduced by more than than 25%.

If you rehire employees that were previously laid off at the beginning of the menstruation, or restore any decreases in wage or bacon that were fabricated at the offset of the period, you will not be penalized for having a reduction in employees or wages. For loans received in 2020, the deadline to exercise so was December 31, 2020. For loans received in 2021, the borderline is the stop of your covered period.

A new exemption on re-hiring employees

Employees who were laid off or put on furlough may not wish to exist rehired onto payroll. If the employee rejects your re-employment offer, you may exist allowed to exclude this employee when calculating forgiveness. To qualify for this exemption:

-

Yous must have made an written offer to rehire in good organized religion

-

Y'all must take offered to rehire for the aforementioned salary/wage and number of hours as before they were laid off

-

You must take documentation of the employee'south rejection of the offer

Note that employees who reject offers for re-employment may no longer exist eligible for continued unemployment benefits.

Further reading: PPP Rules on Rehiring (FAQ)

How will PPP loan forgiveness affect my taxes?

The new nib has confirmed how a PPP loan will touch tax filing. Whatever forgiven PPP loan amount will not be considered taxable income. Additionally, any expenses covered by a PPP loan will still be tax deductible.

Just put, a PPP loan will non impact your taxation filing procedure.

Paycheck Protection FAQs

Can I employ to the PPP through more than one lender?

Aye! There is no harm in applying through more than than 1 lender. Whoever processes your application first will receive an SBA approval number for your business organisation (if you qualify for the loan). This number is called a PLP. The SBA will simply issue one PLP for each Taxation ID, significant there is no chance you lot volition accidentally get approved for two PPP loans.

If you are approved for a PPP loan, your awarding with the other lenders will eventually be rejected, and so it's best to withdraw your application from the other lenders once you've been canonical.

So far, there has been no guidance issued by the Treasury or SBA stating that you can only apply through one lender at a time. In fact, lenders are encouraging businesses to apply through multiple lenders, to increase their chances of getting processed in time.

How does the PPP differ from the SBA disaster loan?

The SBA as well offers an Economic Injury Disaster Loan (EIDL)—ofttimes shortened to just SBA disaster loan. This is a carve up, but like, initiative. Hither's how they differ:

-

No personal or business organisation collateral is required. The SBA disaster loan may require collateral for loan amounts over $25,000.

-

Information technology's ok if you also have access to credit elsewhere. To receive a SBA disaster loan you generally need to take no other source of credit.

-

The funding covers a more restrictive ready of purposes (details below). The SBA disaster loan can cover well-nigh operating expenses.

-

Your loan can be forgiven if you lot follow the terms. The SBA disaster loan requires repayment.

How is the PPP similar to the SBA disaster loan?

-

You need to declare (in good faith) that the doubtfulness of electric current economic weather condition makes the loan necessary for your business.

-

Information technology's free to apply.

-

You take an extended deferment period (vi-12 months, depending on your lender) before you lot begin repayment.

-

In that location is no prepayment penalty.

Can I use for PPP and an SBA disaster loan?

Yes, you can. All the same, you tin't utilize for an SBA disaster loan for the same purpose as the Paycheck Protection Plan.

I reduced my workforce. Will this touch my PPP awarding?

It will bear on your PPP forgiveness application, but only if y'all do not plan on rehiring them or restoring their pay for their typical piece of work hours. Yous must prove that you've maintained the salary and wages of your employees, and that their pay hasn't dropped below 25% of the stated monthly average for your forgiveness application.

I'g a sole prop. How do I evidence my salary if I use owner draws?

If you're a sole prop, average monthly payroll expense is based on your self-employment income. More specifically, this is the net profit reported on your Schedule C. That is the number you lot pay tax on therefore it is treated as your salary. You can ascertain your monthly average payroll expenses as that net profit number for the year divided past 12. Payroll expenses are capped for individuals earning over $100,000 and then if you have greater than $100,000 in net profit, use $100,000 as your total income and thus $8,333.33 as the monthly average.

Further reading: Owner Draws and the PPP

Other PPP resource

- Paycheck Protection Program (PPP) Loans Resources Hub for Small Business

- The Second PPP Loan: What You Need to Know

- The 2d Stimulus Package: A Guide for Small Businesses

- Do I Qualify for the PPP Loan?

- 2020 Taxes: How the PPP, EIDL, and PUA Will Bear on Your Taxes

- How to Use the PPP and EIDL Together

Are Payments To Re-employment Service Fund Deductible On Business Return,

Source: https://bench.co/blog/operations/paycheck-protection-program/

Posted by: graygoodir80.blogspot.com

0 Response to "Are Payments To Re-employment Service Fund Deductible On Business Return"

Post a Comment